The Governing Authority of the City of Avondale Estates has tentatively adopted a 2021 millage rate which will require an increase in property taxes by 2.10 percent.

All concerned citizens are invited to the public hearing on this tax increase to be held at: Avondale Estates City Hall, 21 N. Avondale Plaza, Avondale Estates, GA 30002 on Wednesday, June 16th, 2021, at 12:00 p.m.

Times and places of additional public hearings on this tax increase are at Avondale Estates City Hall on Wednesday, June 23rd at 5:30 p.m. and Wednesday June 30th at 6:00 p.m.

This tentative increase will result in a millage rate of 9.8 mills, an increase of 0.202 mills. Without this tentative tax increase, the millage rate will be no more than 9.598 mills. The proposed tax increase for a home with a fair market value of $400,000 is approximately $32. The proposed tax increase for nonhomestead property with a fair market value of $525,000 is approximately $36.

The purpose of the hearings is to allow public input on the level of service desired by residents and businesses, as well as the millage rate necessary to maintain those services. Over the past three years, City General Fund costs increased by an average of 2.18 percent, so a similar increase in the dollar amount collected from property tax is likely necessary to maintain the same level of service to City residents and businesses in 2021.

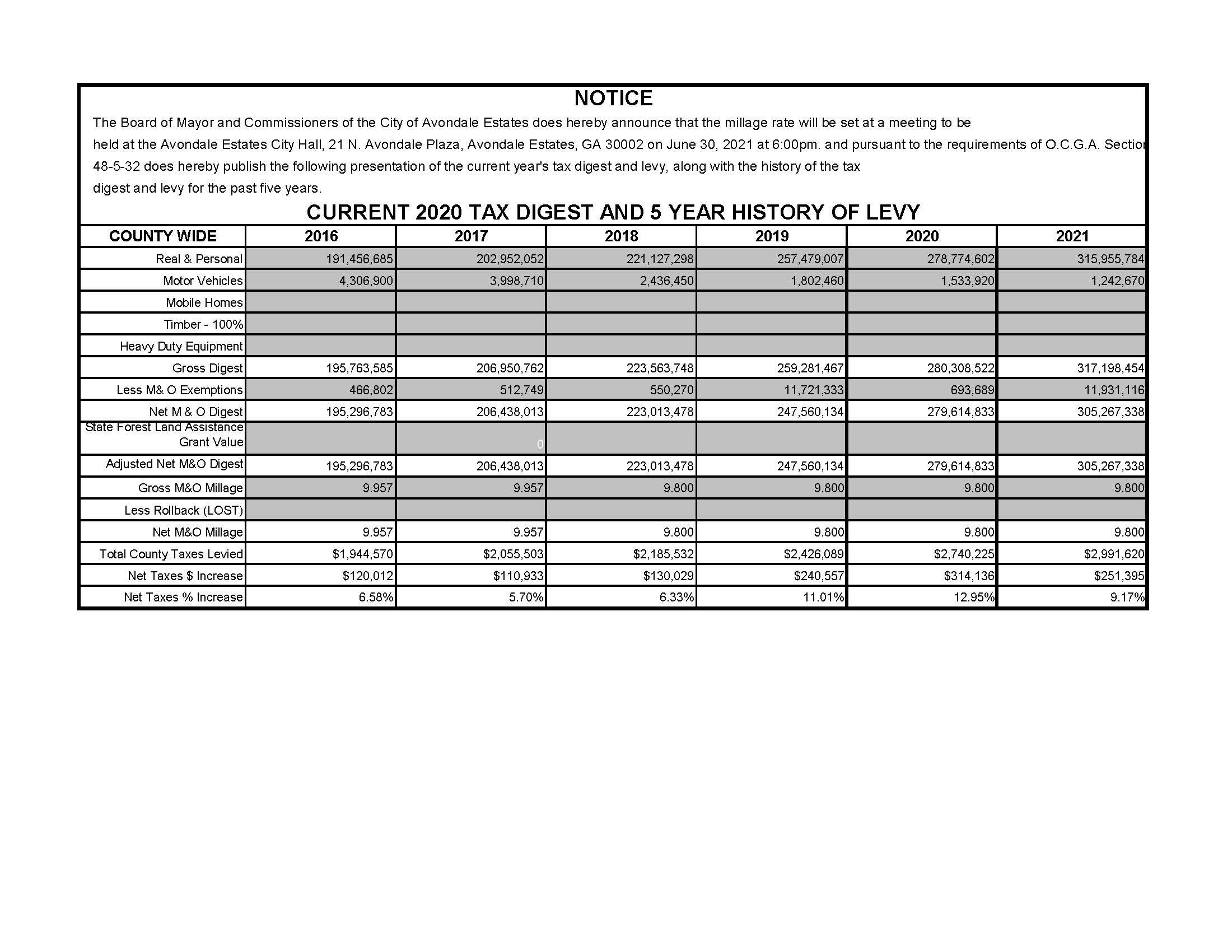

Download the Current Tax Digest and the 5 Year History of Levy.